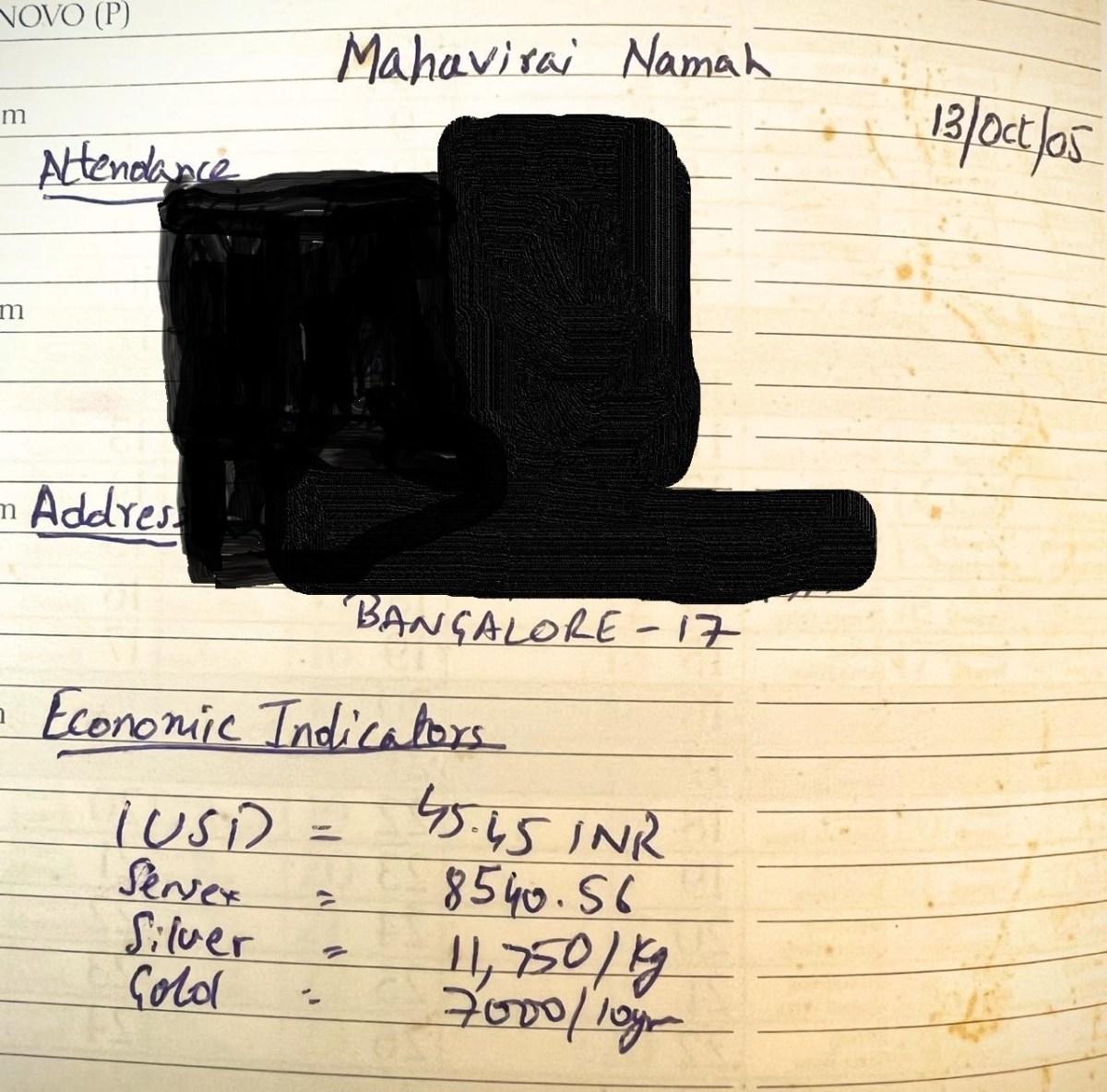

The picture above is dated 13th October 2005 from my diary that I have been maintaining for almost 20 years.

As part of a ritual every Dusshera – after the prayers, in this diary we mark the presence of all the family members who were present at the event, and also record some key financial indicators. At the end of the event– we invariably end of spending some time reviewing the diary entries from earlier years.

An interesting and engaging conversation topic usually ensues around how the financial indicators have changed. The data being discussed and referred is quite simple – just 20 entries created over the last 20 years of Indian exchange rate, SENSEX, Gold and Silver rate.

In our daily hunt for the news, trends we sometimes miss the big picture. In just these 20 entries – it is so easy to see the trends, the significant run up in valuations like what we have seen over the last couple of years or the almost 50% crash that took place in 2008. All of this is captured in those 20 pages.

While there are gasps seeing these changes year on year and over the 2 decades – the discussions invariably getting into the “what-if” scenarios from my daughters.

I want my daughters to keep thinking about a simple rule as they start creating their own diaries over the next few years: Start Early, Be Steady

The Early Advantage

Starting early in personal finance is akin to planting a tree. The sooner you plant it, the more time it has to grow, develop deep roots, and bear fruit. The same goes for your investments. Begin contributing to your investment portfolios as early as you can, and you’ll be amazed at how your wealth can expand over time.

Looking at the data from the diary – the thing that stands out very clearly is that the best time to invest was 20 years ago and the next best is NOW.

Starting Small is Better Than Not Starting at All

Some people hesitate to invest early because they feel they can’t contribute much. Let me tell you: every little bit helps. Starting with small amounts is far better than waiting until you can invest a large sum. The beauty of starting early is that time is working in your favor. Whether it’s INR 500 or INR 1,000 a month, every small investments add up over time.

The sooner you start, the less you have to stress about “making up for lost time” later on.

Refer to an earlier article which provides more details on the Power of NOW….titled “The FUTURE is NOW: Why Your Wealth Journey Should Start Today.”

The Perils of Frequent Trading

While it’s important to review your investment strategy periodically, frequent trading can be hazardous to your financial health. Every time you buy or sell an investment, you rack up fees, taxes, and you might even miss out on significant growth during market recoveries.

There is so much research on this topic and for further reading refer one of my earlier blogs where I had covered the comparison between Investor Returns and Market Returns.

The Market Has Ups and Downs—Don’t Let It Rattle You

Investors often panic when they see market dips or corrections, but here’s a truth many forget: the market has always recovered over time. Sure, it’s stressful when you see your portfolio lose value temporarily, but reacting emotionally can lead to selling at the worst possible time—locking in your losses. The key is to ride out the volatility. History shows that markets tend to bounce back, and if you pull out too soon, you could miss out on the recovery.

Take the 2008 financial crisis, for example. People who sold their stocks during the downturn may have avoided short-term losses, but they also missed out on the significant market gains in the following years. On the flip side, those who held steady and stayed invested saw their portfolios recover and grow significantly.

The “best” asset class changes every year and it’s difficult to make predictions. You may want to read an earlier blog on the difficulty in making predictions and how to handle this with aplomb.

Stick to Your Strategy and Review Annually

This doesn’t mean you should never look at your investments. I recommend reviewing your portfolio about once a year or so to ensure it aligns with your financial goals and risk tolerance. If your investments have grown significantly or if your goals have changed, you may need to rebalance your portfolio. But this should be done strategically—not in response to every market dip or piece of financial news.

For example, as you get closer to retirement, you may want to shift more of your investments into lower-risk assets. This should be done gradually and in line with a long-term plan—not as a knee-jerk reaction to short-term market conditions.

The Power of Patience

Patience is a virtue, especially in personal finance. By not touching your investments too frequently, you allow them to grow through the market’s ups and downs. Remember, it’s time in the market, not timing the market, that builds wealth.

My last post on the important of Patience deep dives into this virtue.

Conclusion

Take control of your financial future today by starting early, investing wisely, and staying the course. Your future self will thank you.

“…..your investment portfolio can be like a bar of soap – the more you handle it, the less you will have.“