Hey there, My Money Box Community! 👋

When it comes to seeking inspiration and knowledge, it’s natural to gravitate towards the success stories. After all, why would you invest time reading about a founder who faced failure after failure without a glimmer of success? The allure of learning from the victorious is hardwired into us. But herein lies a potential pitfall: the overlooked phenomenon of Survivorship Bias.

Survivorship Bias skews our understanding by focusing solely on those who’ve made it through the gauntlet, while ignoring the many who may have fallen along the way. This bias can lead us to draw conclusions from an incomplete set of data, often painting a rosier picture than reality warrants.

Take, for example, a classic case of survivorship bias from World War II. The U.S. military, in their efforts to fortify aircraft, initially only considered the damage on planes that returned from battle. It was the insightful mathematician Abraham Wald who pointed out that they were overlooking crucial data – the damage on planes that didn’t make it back. By only considering the survivors, they were inadvertently planning to reinforce the very parts of the plane that were least vulnerable.

This same bias can be seen in modern narratives. Gyms might showcase success stories of rapid transformations, yet they conveniently omit the accounts of the vast majority those who saw no results despite their financial investment.

Similarly, we often hear tales of individuals who achieved billionaire status without the benefit of a university education – Bill Gates and Mark Zuckerberg being prime examples. These stories captivate us with the idea that if they can succeed without formal education, so can we. However, this perspective is a classic case of Survivorship bias, ignoring the vast majority who may not achieve such success without higher education.

In the realm of entrepreneurship, advice from those who have 'made it' can be misleading if it doesn't account for survivorship bias.

Survivorship Bias in Personal Finance

The same holds true in finance, where studies on mutual fund performance may only consider “active” funds, excluding those that have merged, restructured, or failed.

Survivorship bias can lead us to think things are better than they really are because it only looks at the examples that made it through tough times. It ignores all the cases that didn’t survive those same challenges.

Example of Survivorship Bias in Personal Finance

Consider the following information about mutual fund returns:

| Mutual Fund Scheme | Returns | Scheme Status |

|---|---|---|

| Scheme A | 10% | Active |

| Scheme B | 12% | Active |

| Scheme C | 2% | Closed |

| Average Return All Schemes | 8% | |

| Average Return Active Schemes | 11% |

When you took out the average of all active schemes in the table above, you find that your net return was 8%. On the other hand, if you check the average of the first active schemes only, it turns out that the average is 11% which is 3% more than the average of All Schemes.

Now, if you base your decision of future investment on the basis of only Active mutual funds, it will come with survivorship bias risk. Whereas, the actual result of 8% return shows that you should invest in mutual funds taking into consideration the lower returns from the closed schemes also.

Overcoming Survivorship Bias

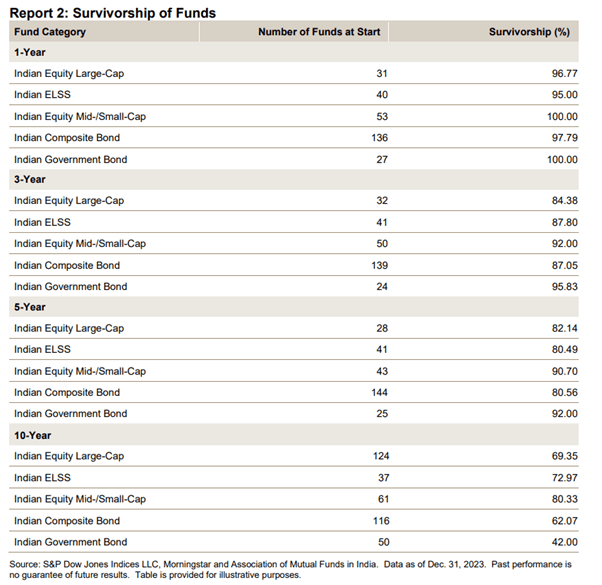

The SPIVA India Year-End 2023 report that I used in an earlier blog post titled “The Tortoise Wins Again” has the following table on the Survivorship of Funds in Indian MF industry:

The report details how it handles Survivorship Bias in the notes to its research:

“Some funds liquidate or merge during a period of study. This usually occurs due to continued poor performance by the fund. Therefore, if index returns were compared to fund returns using only surviving funds, the comparison would be biased in favor of the fund category. The SPIVA reports remove this bias in three ways. The first method to remove the bias is to use the entire investment opportunity set, made up of all funds in that particular category at the outset of the period, as the denominator for outperformance calculations. The second is to show explicitly the survivorship rate in each category. The final way is to construct a peer average return series for each category based on all available funds at the outset of the period.”

While you might not be able to do this level of detailed analysis, but it helps to be aware of this bias.

Survivorship Working in your Favor?

Now, let’s talk about the advantage of Index Funds and Survivorship. When it comes to stock indices like the SENSEX, NIFTY50, or NIFTY100, Survivorship can actually work in your favor. Investing in Index funds mitigates the risk of significant loss from individual company failures, as these funds follow the success stories and adapt to market changes.

How does this work? Consider an Index Fund. It automatically adjusts its holdings, selling off shares of companies that fall out of the index due to decreased market capitalization or other factors, and replacing them with rising contenders. This rebalancing act ensures that your investment is always aligned with the current winners, without the need for you to actively manage or predict market trends.

The beauty of an index tracker is that it requires minimal effort on your part. As the market evolves, so does your portfolio, potentially including the next big success stories in industries that may not even exist today. And while individual stocks can deliver unpleasant surprises, an index tracker provides a safety net through diversification – it’s unlikely to drop to zero as long as the overall market endures.

Warren Buffett, in his wisdom, has even advocated for the simplicity and effectiveness of low-cost index trackers. In his 2013 letter to shareholders, he advised that the majority of his estate be invested in such a tracker, underscoring the value of this approach.

Conclusion

While it’s important to celebrate and learn from success, it’s equally crucial to understand the full picture. Survivorship bias can lead to overly optimistic conclusions that don’t always hold up in the real world. By acknowledging and adjusting for this bias, we can make more informed decisions, both in finance and in life.

5 out of 6 scientists say that Russian roulette is safe …

😊😊😊