Hey there, My Money Box Community! 👋

It’s not that individuals at age of 50-60 have all the wealth!!!

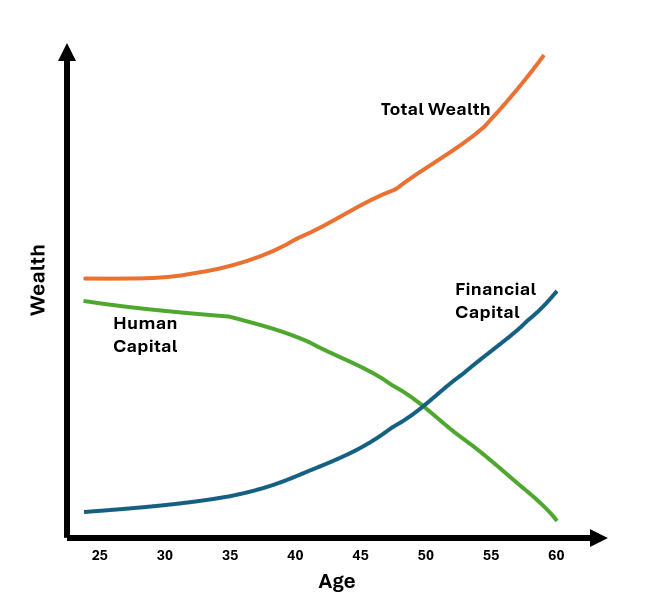

Even someone who is at the at the cusp of starting their career (25-30) have similar wealth. It’s just important to recognize that the youth possess a form of wealth that is often overlooked, yet it holds immense potential for their financial future.

To explain this concept, let us examine the typical financial lifecycle, which can be segmented into three distinct stages: education, employment, and retirement.

During the initial phase of life, individuals focus on education and skill development. This foundational period not only shapes our identity but also equips us with the means to generate income throughout our professional lives. We refer to this potential as “Human Capital,” defined as the present value of expected future earnings across one’s lifetime. Empirical data robustly supports the correlation between the level of education attained and the present value of an individual’s earning capacity. In essence, education represents a strategic investment in one’s human capital.

As individuals transition into the workforce, their human capital typically reaches its peak. Conversely, their financial wealth is often minimal at this juncture. It is during this “accumulation stage” that the transformation of Human capital into Financial capital commences. This is achieved through the earning of salary and the prudent act of saving a portion of these earnings.

Progressing through life, the value of human capital decreases. However, with disciplined savings and careful investment in financial markets, an individual’s financial capital expands, eventually overtakes the human capital as the predominant asset in their wealth portfolio.

Upon entering retirement, human capital is substantially diminished, though not entirely exhausted, as residual savings may continue to yield annual income. At this stage, wage-earning capacity is significantly reduced and no longer constitutes the principal component of one’s wealth. Predominantly, retirees possess considerable financial capital, which they will utilize throughout their retirement years, often bequeathing any remaining assets to their descendants.

It is, therefore, crucial to comprehend that an individual’s total wealth is comprised of two elements: Human and Financial capital. Throughout one’s lifetime, a conversion from one form to the other transpires. The youth embarking on their professional endeavors must recognize this dynamic and judiciously manage the conversion to maximize their overall wealth.

In a forthcoming post, I will delve into specific strategies that can effectively navigate this conversion throughout the various stages of an individual’s life. Stay tuned for insights that can empower you to harness the full potential of your human capital and ensure a prosperous financial trajectory.