Hey there, My Money Box Community! 👋

Let’s kick things off with a quote from the Oracle of Omaha himself, Warren Buffett: “Someone is sitting in the shade today because someone planted a tree a long time ago.”

This nugget of wisdom encapsulates the essence of our topic. Investing early isn’t just about stashing away cash; it’s about planting seeds that grow into a forest of financial freedom.

Why Start Early? The Time Advantage

The biggest reason to start investing early is simple: Time.

Time is the secret ingredient that allows your investments to marinate and mature into a flavourful financial feast. The earlier you start, the more time your money has to grow through the power of compounding.

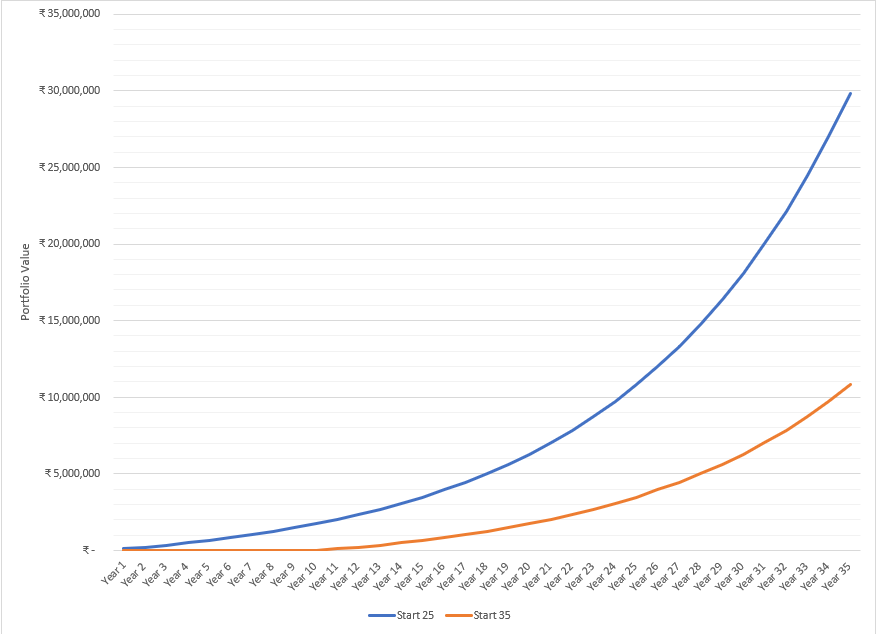

Consider this: If you start investing INR 1 Lac a year at age 25, assuming an average annual return of 10%, you’d have around INR 3 Crore by age 60. Now, if you were to wait until you’re 35, and that number drops to about INR 1.1 Crore. That’s more than two third the potential wealth, gone!

As the brilliant physicist Albert Einstein allegedly said, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.“

The Magic of Compounding: A Financial Fairy Tale

Compounding is the process where the earnings on your investments start earning their own money. It’s like your money having babies, and then those babies have babies, and so on. It’s a family tree of wealth that grows exponentially over time.

To illustrate, let’s say you invest INR 1Lac and it grows by 10% in the first year. You’ve got INR 1.1 Lac by the end of Year 1. In the second year, that 10% growth applies to the entire INR 1.1 Lac, not just your initial investment. This cycle continues, with each year’s gains building upon the last. Over decades, this can lead to an explosion in the value of your investments.

The Risks of Waiting

The risks of waiting to invest include missing out on years of compounding, needing to save much more later in life to catch up, and ultimately, potentially compromising your financial future. Procrastination is the thief of potential wealth.

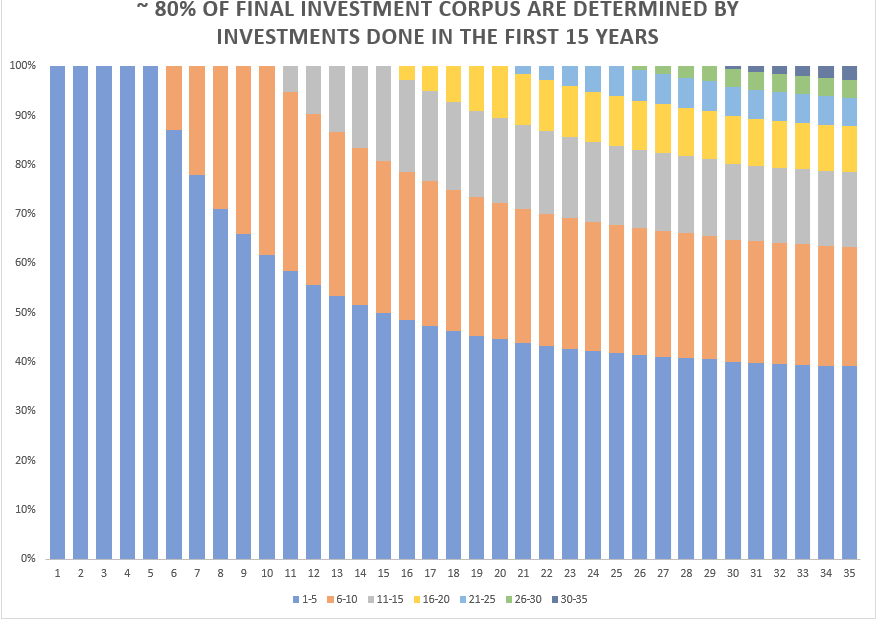

To illustrate this, if we take the example given above the bucket the investments done over 35 years into 7 buckets of 5 years i.e.

Bucket 1: Investment Years 1 to 5

Bucket 2: Investment Years 6 to 10

Bucket 3: Investment Years 11 to 15

Bucket 4: Investment Years 16 to 20

Bucket 5: Investment Years 21 to 25

Bucket 6: Investment Years 26 to 30

Bucket 7: Investment Years 31 to 35

If we were breakdown the final portfolio of around INR 3 Crore in the example given above, you might be surprised to see that:

Bucket 1 contributes to almost 40% of the Final Portfolio

Buckets 1 and 2 combined contribute to almost 65% of the Final Portfolio

Buckets 1, 2 and 3 combined contribute to almost 80% of the Final Portfolio

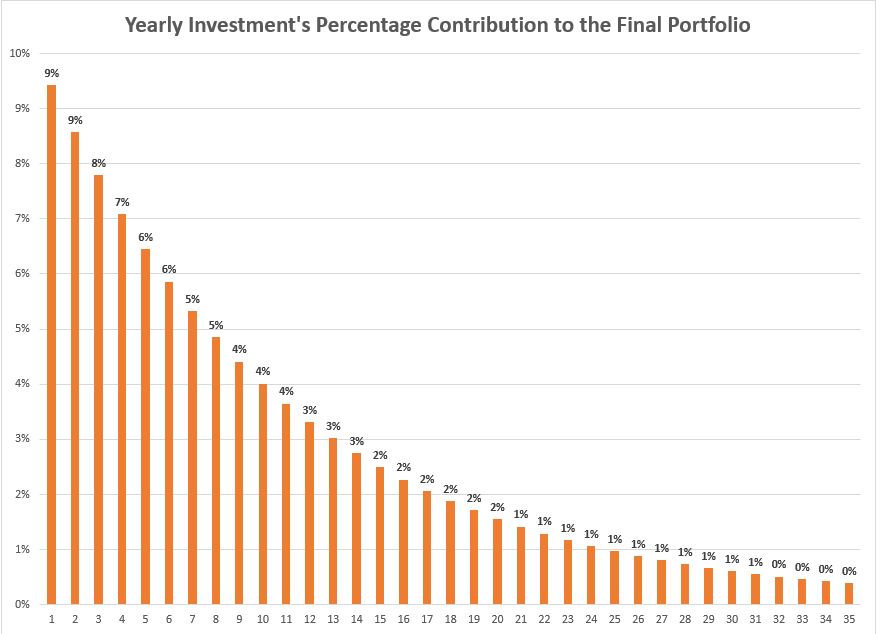

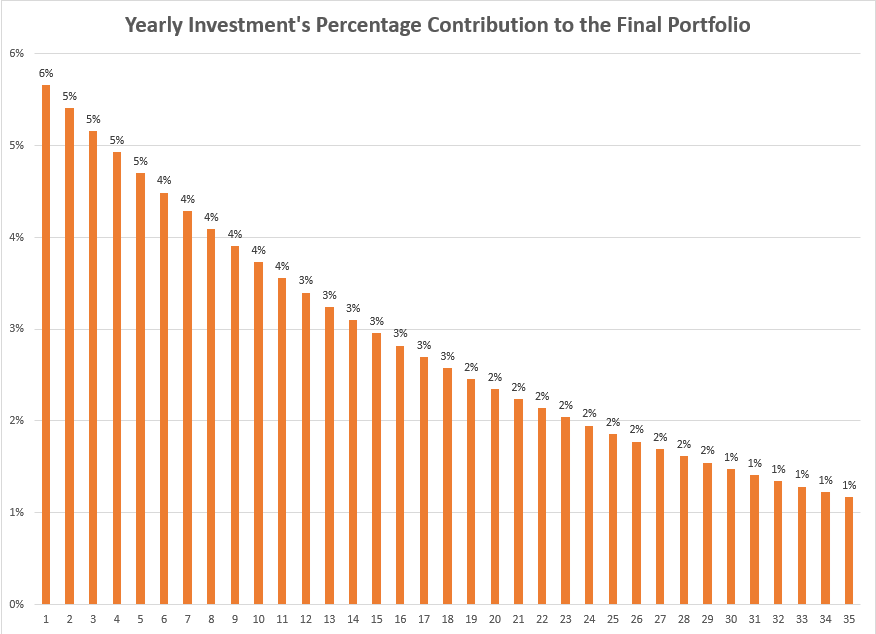

Another way to look at this graphically is the percentage contribution to the final portfolio from the yearly investments.

Money invested earlier typically grows more than investments later in time.

What this clearly shows is that the investment in the initial years has an outsized contribution to the Final Portfolio. Even if you were to stop investing after the initial 15 year (skip 20 years of investing) …you would still make it to about the 80% of your “ideal” portfolio value of INR 3 Crores.

The other perspective

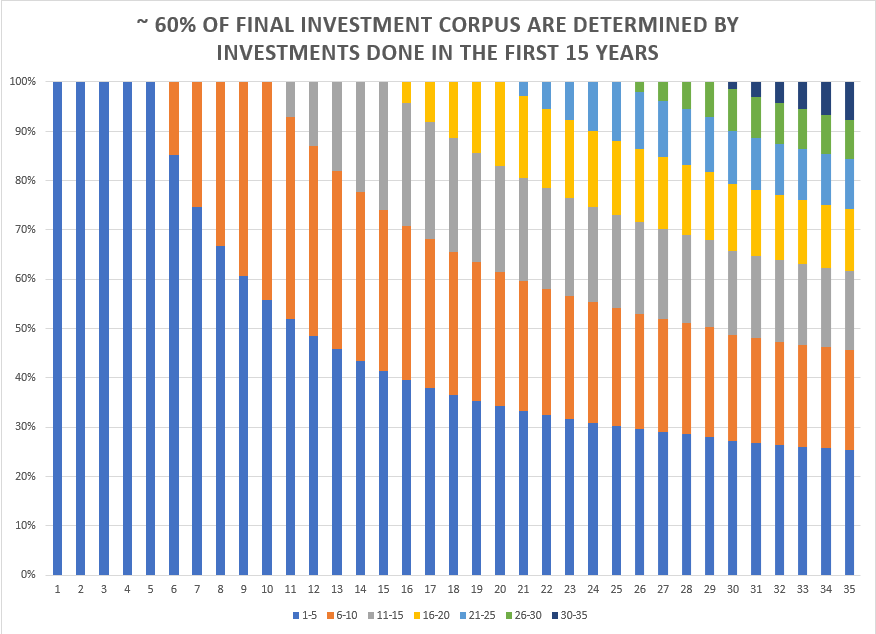

If you have looked at the example carefully for assumptions – you would immediately realize that this is not a realistic scenario. No one invests a constant sum of money every year for 35 years. The amount invested starts small and then increases with income.

To make this more realistic – now let’s assume you start investing INR 1 Lac a year at age 25, assuming an average annual return of 10% and an increase of 5% in your investment amount every year, you’d have around INR 5 Crore by age 60. That is almost INR 2 Crore more than the original example. Now, if you were to wait until you’re 35, and that number drops to about INR 2.7 Crore. Now, that’s almost a 50% the potential wealth (INR 5 Crore), missed!

While there is a significant drop, this seems a bit better that the earlier scenario wherein there was a 2/3 drop. Why is this? This is because you are investing higher amounts year on year and to a small extent it reduces impact of the delay of start of the investing journey.

Now, with the same definitions:

Bucket 1 contributes to almost 25% of the Final Portfolio

– (down from 40% earlier)

Buckets 1 and 2 combined contribute to almost 45% of the Final Portfolio

– (down from 65% earlier)

Buckets 1, 2 and 3 combined contribute to almost 60% of the Final Portfolio

– (down from 80% earlier)

Again, another way to look at this graphically is the percentage contribution to the final portfolio from the yearly investments.

So, should you be worried…if you have started your journey late? Yes and No

If you are sitting, there and are getting worried that you missed 5 or 10 years of the magic of compounding – there is little benefit of worrying. It is still possible to get to the targeted portfolio value however it will be tougher, and you might want to temper your expectations. Work with a financial planner to come up with a plan which can try and get you closer to your goals.

Remember: Compounding money is easier than saving money.

Until next time, happy investing, and may your finances flourish!

2 thoughts on “The FUTURE is NOW: Why Your Wealth Journey Should Start Today”