Hey there, My Money Box Community! 👋

Unveiling the newest data on the Active versus Passive investment showdown. The S&P Indices Versus Active Funds (SPIVA) scorecard, our go-to for over a decade, has just published some eye-opening revelations you savvy investors cannot afford to miss. The focus – performance of actively managed Indian equity and bond mutual funds stacked against their benchmark indices over various investment timelines.

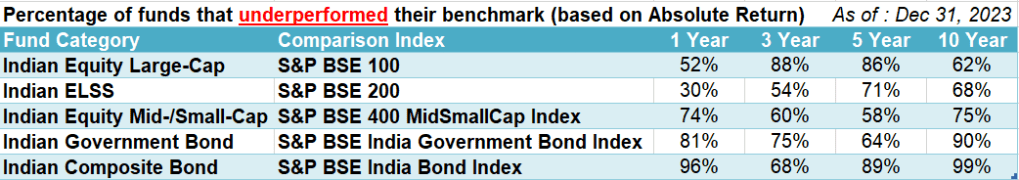

The data does make us pause and question the effectiveness of actively managed funds. The SPIVA India Scorecard 2023 reveals a sobering reality – a considerable chunk of actively managed funds have lagged behind their benchmarks across different categories.

For instance, did you know that over half (52%) of Indian Equity Large-Cap funds could not beat the S&P BSE 100 index in 2023? The underperformance rates paint a grimmer picture over three- and five-year periods, making a home run at 88% and 86%, respectively.

So, what’s the takeaway for investors? Yes, actively managed funds have a “chance” to outshine the market. But, there’s a catch – they often struggle to do it consistently. Before you pin your hopes on such funds, do a deep dive into their track record and fees.

This report clearly outlines the potential advantages of low-cost index funds, providing a viable alternative that keeps pace with a specific market index.

And before we feel singled out, let’s remember, these patterns aren’t unique to India. Delve into the SPIVA website and discover similar trends across both developed (US, Canada, Europe, Japan, Australia) and developing (Brazil, India..) markets.

Let’s talk about your financial strategy – are you team Active or Passive? Drop your experiences below and let’s learn together.

Refence: S&P Dow Jones Indices

One thought on “The tortoise wins again!!!”