Over the last week there has been a spurt in discussions on the traditional insurance cum savings products and how they are misunderstood by investors in India. Many of us know that these products have multiple layers of charges that make them difficult to understand and operate. So I thought of highlighting how the investment returns differ with different levels of Fee charged by the investment service providers. The Fee can be charged in many forms in different products but they end up impacting the return that we get as an investor.

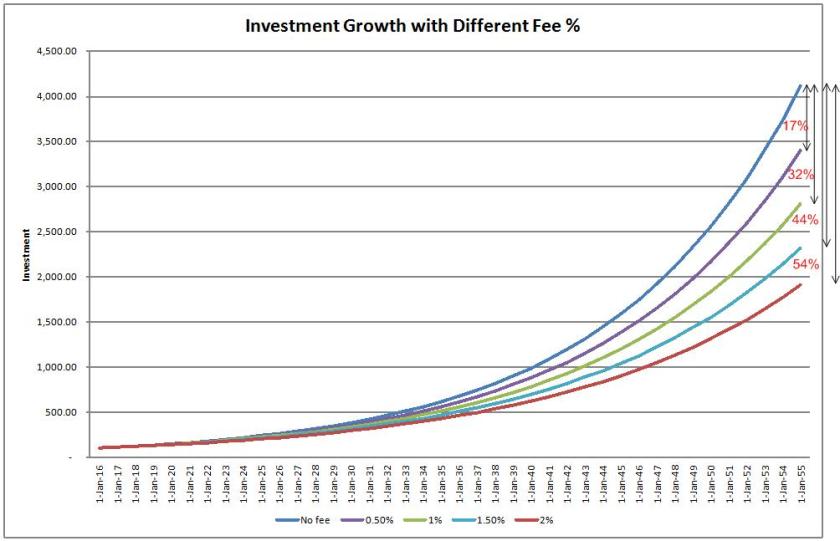

In the graph below, I have taken a nominal sum of Rs 100 and shown its growth over 40 years, assuming a 10% yearly growth, with 5 different scenarios – No Fee (heaven!!!), 0.5%, 1%, 1.5% and 2% annual fee.

As seen from the chart above, the final return is as follows:

- No fee – Rs 4,114

- 0.5% fee – Rs 3,400 (17% lesser than No fee scenario)

- 1% fee – Rs 2,808 (32% lesser than No fee scenario)

- 1.5% fee – Rs 2,316 (44% lesser than No fee scenario)

- 2% fee – Rs 1,909 (54% lesser than No fee scenario)

So what is happening here??? Why is just a small percentage of fee impacting the final returns in a significant way. The answer is Compounding!!!

In case of the “No fee scenario” your complete investment and its previous years returns are available to be compounded every year. However in all other scenarios the amount available for investment at the beginning of every year gets a cut due to the fee being charged to this corpus. Hence the amount that gets invested in Year 2/3/4.. is lower. This decrease in investible amount is directly proportional to the fee being charged. If this keeps happening over an extended period of time (as highlighted in the example above) – the inconsequential fee percentage can have a significant impact on the final returns that you get.

I am not putting a case against payment of fee for managing your investments – however the fee needs to be justified by either higher returns and/ or convenience otherwise it is a drag on your investments. Getting superior returns with a high fee is like trying to swim with a rocks attached to your legs.

In the example above I have taken a very long period of time to highlight the extent of drag over an extended period of time but no matter what the investment duration is considerend – the drag is real.

So, when you review different investment products – ranging from direct stock investments, ETF, Index Mutual Fund, Actively managed Mutual Fund, Direct Mutual Fund Portfolio Management Schemes, ULIPs do pay attention to the fee which might be mentioned at the end in fine print.

Please use the comment section below to share the analysis that you might have done, what have you observed. In case you want the xls behind the graph, please drop a comment below.

Happy Investing!!!

Very well researched write up.

LikeLike

Very interesting , in. the long run it will definitely increase the portfolio

LikeLike

Anand – I believe you meant that the returns will decrease.

LikeLike